Corporate Tax Returns UK require precise and accurate translations due to the complexity of UK tax laws. Businesses operating internationally must engage professional UK translation services that specialize in legal and financial documentation, ensuring linguistic accuracy and a deep understanding of both UK GAAP and IFRS. These specialized services provide native-speaking tax professionals with accounting expertise who can accurately translate financial terms and navigate the complexities of cross-jurisdictional legal systems to maintain regulatory compliance and avoid legal and financial repercussions. For enhanced precision, choose translation services that offer proofreading by additional tax law experts, thereby guaranteeing both the grammatical accuracy and the preservation of the original document's intent for corporate tax returns in the UK.

navigating the intricate web of UK tax legislation is pivotal for multinational corporations. Accurate translations of corporate tax documents are not just a formality but a legal necessity. This article delves into the critical role of professional translation services in ensuring that corporate tax returns meet the stringent regulatory standards required by the UK. We explore key considerations for translating financial documents, the implications of mistranslations, and the importance of linguistic precision. By examining case studies and outlining best practices, this guide aims to assist corporations in selecting specialized translation services, thereby safeguarding their compliance with UK tax laws. Corporate Tax Returns UK translation services play a crucial role in this process, ensuring that every detail is accurately conveyed and understood by the relevant authorities.

- Understanding the Necessity of Accurate Translations for Corporate Tax Returns in the UK

- The Role of Professional Translation Services in Navigating UK Tax Legislation

- Key Considerations for Translating Financial Documents to Ensure Regulatory Compliance

- The Implications of Inaccurate Translations on Corporate Tax Returns

- Identifying Reliable UK Translation Services for Your Corporate Tax Documents

- The Importance of Linguistic Nuances in Tax Document Translation

- Case Studies: Real-World Examples of Translation Impacting Tax Compliance

- Best Practices for Translating and Localizing Corporate Tax Returns for the UK Market

- How to Select a Translation Service with Specialized Knowledge in Corporate Tax Laws

Understanding the Necessity of Accurate Translations for Corporate Tax Returns in the UK

Companies operating within the UK’s corporate landscape are required to submit accurate and comprehensive tax returns to comply with Her Majesty’s Revenue and Customs (HMRC) regulations. The intricacies of UK tax law necessitate precise translations for multinational corporations that conduct business in multiple languages or use foreign subsidiaries. Translating corporate tax returns accurately is not merely a linguistic exercise; it is a legal requirement that safeguards businesses from potential penalties and legal complications. Utilising professional UK translation services ensures that the semantic nuances of tax legislation are accurately conveyed, minimizing the risk of misinterpretation or non-compliance. These services offer expertise in accounting jargon and tax regulations, which is crucial for the correct translation of financial data and documentation. By adhering to this standard, businesses can confidently navigate the complexities of UK corporate tax law, avoiding costly errors and ensuring their legal obligations are met with precision. Furthermore, engaging specialized translation services for tax-related documents demonstrates a commitment to transparency and due diligence, reinforcing the company’s reputation with regulatory bodies and stakeholders alike.

The Role of Professional Translation Services in Navigating UK Tax Legislation

Companies operating in the UK with multilingual operations must adhere to stringent tax regulations, which are intricate and subject to frequent updates. In this context, professional translation services play a pivotal role in ensuring that corporate tax returns are accurately translated into the appropriate languages, facilitating compliance with UK tax legislation. These specialized services offer not only linguistic expertise but also an intimate understanding of the tax domain. Translators who specialize in legal and financial documentation are adept at navigating the nuances of both language and tax law, which is essential for maintaining accurate records and avoiding potential legal pitfalls. By leveraging the expertise of these professionals, businesses can be confident that their tax documents are not only linguistically correct but also reflect the precise intent of the original UK tax legislation. This precision is crucial for multinational corporations to uphold their financial integrity and to ensure that they are compliant with all statutory requirements, thereby safeguarding their operations within the UK market.

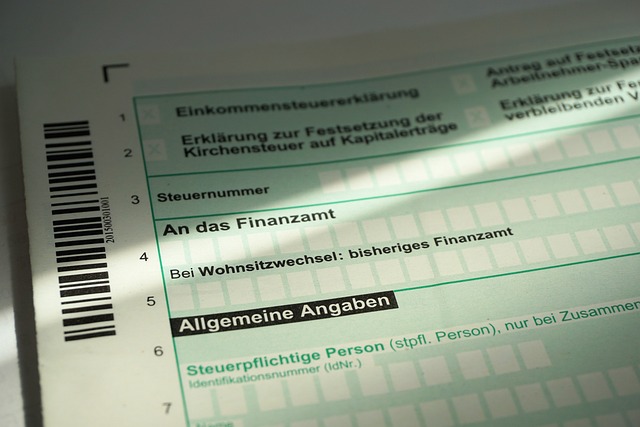

Key Considerations for Translating Financial Documents to Ensure Regulatory Compliance

When translating corporate tax returns for the UK market, it is imperative to adhere strictly to regulatory standards set forth by the HM Revenue & Customs (HMRC) and other relevant authorities. The accuracy of these documents is paramount, as they often involve complex financial data that must be represented precisely in the target language. UK translation services specializing in legal and financial documents can provide certified translators who are well-versed in both the linguistic nuances and the specific regulatory requirements of tax documentation. These professionals ensure that each figure, term, and clause is correctly interpreted and translated, thus maintaining the integrity of the original document. This precision is crucial for compliance purposes, as any discrepancies or mistranslations could lead to legal complications or financial penalties. Moreover, employing a translation service with expertise in corporate tax returns ensures that the translation meets the necessary legal standards, facilitating smoother audits and reviews by regulatory bodies. It is through this meticulous approach that companies can navigate the complexities of cross-border tax compliance with confidence, minimizing the risk of non-compliance and its associated repercussions.

The Implications of Inaccurate Translations on Corporate Tax Returns

Inaccurate translations in corporate tax returns can have severe repercussions for multinational entities, particularly when navigating the complex regulatory environment of the UK. The UK’s translation services are critical in ensuring that all financial documentation is accurately conveyed to comply with Her Majesty’s Revenue and Customs (HMRC) standards. A single error in a translated document can lead to misinterpretations of financial data, potentially resulting in penalties, additional scrutiny, or even legal disputes. These mishaps not only affect the entity’s fiscal integrity but also its reputation within the market and with regulatory bodies. To mitigate such risks, it is imperative for businesses to engage with professional translation services that specialize in corporate tax returns. Such services offer precise translations that align with UK accounting standards and legal terminology requirements, thus minimizing the likelihood of compliance issues and maintaining the accuracy and integrity of financial records across borders.

Furthermore, the stakes are particularly high when dealing with multijurisdictional tax obligations, where a nuanced understanding of both the source and target languages is essential. Translators must be well-versed in not only the linguistic aspects but also the cultural contexts that could influence the interpretation of tax terms. This expertise ensures that all disclosures, calculations, and annotations on the translated corporate tax returns are accurate and compliant with UK regulations. By leveraging expert translation services for corporate tax returns, companies can confidently navigate the complexities of international tax laws, avoiding potential pitfalls and maintaining compliance, which is essential for their long-term success and legal standing in the UK market.

Identifying Reliable UK Translation Services for Your Corporate Tax Documents

navigating the intricate world of corporate tax returns in the UK necessitates impeccable documentation and precise translations. Reliable UK translation services are paramount for ensuring that your financial documents accurately reflect the original content in English, adhering to both linguistic nuances and regulatory standards. When selecting a service provider, consider their expertise in legal and financial translations, as well as their familiarity with the specific terminologies used within corporate tax documentation. A competent translation service will not only translate your documents but also localise them, taking into account the UK’s unique business practices and tax laws. This localisation process ensures that your translated tax returns are compliant with UK regulations and accurately convey the necessary financial information to the relevant authorities. Additionally, look for translation services that offer certification or notarization of translations, as this can be a legal requirement for official documents. By choosing a service with a strong track record in corporate tax document translation, you mitigate the risk of errors that could lead to compliance issues or financial discrepancies.

The Importance of Linguistic Nuances in Tax Document Translation

Navigating the complexities of corporate tax returns in the UK requires meticulous attention to detail, especially when translated for entities operating across linguistic boundaries. Translation services play a pivotal role in this process, as they must capture not just the literal meaning but also the nuances inherent in the original text. Linguistic precision is paramount, as slight misinterpretations can lead to discrepancies that may raise compliance issues with tax authorities. The translation of corporate tax documents necessitates a deep understanding of both the source and target languages, as well as the specific terminologies used within the field of taxation. This is where specialist UK translation services excel, offering expertise in both language and subject matter to ensure that all linguistic nuances are accurately conveyed. Such precision is crucial for maintaining the integrity of financial reporting and for avoiding any legal implications stemming from mistranslations. By leveraging the capabilities of seasoned translators who specialize in corporate tax returns UK translation services, businesses can navigate this complex terrain with confidence, ensuring that their translated documents are compliant and reflective of the original intent and details. This level of accuracy is not just a matter of linguistic prowess but a critical component of adhering to regulatory standards and maintaining a company’s financial integrity.

Case Studies: Real-World Examples of Translation Impacting Tax Compliance

In the realm of corporate tax compliance, the accuracy and precision of translated tax documents are paramount. For instance, a multinational corporation with operations in the UK faced significant challenges when preparing its tax returns. The intricacies of UK tax law necessitated a thorough understanding that extended beyond the original language of the company’s financial records. By engaging specialized UK translation services, the company successfully navigated the complexities, ensuring that all translated tax documents accurately reflected the original data and adhered to the stringent requirements set forth by the UK tax authorities. This case underscores the critical role that professional translation services play in maintaining regulatory compliance across different jurisdictions.

Another case study illustrates the consequences of misinterpretation due to inadequate translation. A foreign-owned subsidiary in the US failed to appreciate the implications of certain tax provisions when their corporate tax returns were improperly translated. The mistranslation led to discrepancies that triggered an audit by the Internal Revenue Service (IRS). Through a meticulous review and rectification process, with the assistance of competent translation experts, the subsidiary resolved the issues and avoided potential penalties. These real-world examples highlight the importance of leveraging corporate tax returns UK translation services to ensure that every nuance is accurately conveyed, thus upholding compliance with tax regulations in a globalized business environment.

Best Practices for Translating and Localizing Corporate Tax Returns for the UK Market

When navigating the complexities of corporate tax returns in the UK, it is imperative for businesses to engage with professional UK translation services that specialize in legal and financial documents. Translating corporate tax returns involves not just linguistic precision but also a deep understanding of both the source and target regulatory frameworks. To ensure accuracy and compliance, translators should be well-versed in UK Generally Accepted Accounting Principles (UK GAAP) as well as International Financial Reporting Standards (IFRS), if applicable. Utilizing native-speaking tax professionals who possess accounting expertise is a best practice that enhances the quality of translation and localization. These experts can bridge the gap between different legal systems, ensuring that all numerical data and financial terminology are accurately conveyed in the target language. Moreover, they can adapt the presentation and disclosure requirements to align with UK standards, thereby minimizing the risk of misinterpretation or non-compliance by tax authorities.

In addition to linguistic and technical proficiency, confidentiality and data security must be paramount when handling sensitive financial information. Trustworthy translation services in the UK will implement robust security measures to protect clients’ proprietary data throughout the translation process. By leveraging secure communication channels and compliance-focused workflows, businesses can confidently entrust their corporate tax returns to these specialized service providers, knowing that their documentation will be both accurately translated and discreetly handled. This dual commitment to precision and privacy is essential for companies operating in the UK market, as it upholds the integrity of their financial statements and safeguards their competitive edge.

How to Select a Translation Service with Specialized Knowledge in Corporate Tax Laws

When entrusting your corporate tax returns for translation within the UK context, selecting a translation service with specialized knowledge is paramount to ensure both accuracy and compliance with regulatory standards. Opt for providers that have demonstrable expertise in corporate tax laws, particularly those familiar with the intricacies of UK tax legislation. These specialists are adept at navigating complex tax codes and can accurately translate financial terminology and legal jargon, which is crucial for an unimpeachable tax submission. Look for translation services that offer a team of professional translators who are not only linguistically proficient but also hold certifications or have experience in accounting and finance. This dual expertise ensures that the translated documents are both grammatically correct and reflective of the original intent, minimizing the risk of misinterpretation by tax authorities. Additionally, consider services that offer proofreading by a second tax law expert to double-check for precision and compliance. The choice of a translation service with a proven track record in handling corporate tax returns for UK entities will provide peace of mind and support your organization’s adherence to legal and tax obligations.

In concluding, the meticulous translation of corporate tax returns for the UK market is not merely a bureaucratic task but a critical function that underpins legal compliance and financial integrity. The intricate nature of tax legislation necessitates professional expertise to navigate its complexities accurately. Selecting a translation service with specialized knowledge in UK corporate tax laws, as discussed, is paramount to mitigate the risks associated with inaccuracies and ensure regulatory adherence. By adhering to best practices for translating and localizing financial documents, businesses can confidently submit their tax returns, secure in the knowledge that linguistic nuances have been considered and that their submissions are clear, precise, and compliant with UK standards. With the right translation partner, companies can effectively bridge the language divide while maintaining transparency and accountability within the tax framework.